In the United Arab Emirates, the Federal Tax Authority issues a unique Tax Registration Number (TRN) to each person or business registered for tax purposes so that they can be identified, report compliance, and keep records.

When a registered business receives supplies from a registered person, it is helpful to ensure that input tax on the supply can be claimed without any problem.

Customers can verify the VAT status of a business with a TRN number for added peace of mind while handling business.

Due to the potential frauds associated with Value Added Tax (VAT), TRN Verification and VAT Verification have become extremely important.

Fraudulent VAT charges can be made using fake TRNs, resulting in the government losing revenue.

The UAE VAT Law requires registered businesses to include their Tax Registration Number with every invoice.

FTA provides the ability to verify the validity of a TRN on an invoice or quote by a supplier as a way of assisting in this process.

How To Verify TRN Number?

Verifying the authenticity of a VAT registered business can be accomplished by doing a TRN Check on the person making the claim.

Taxable persons with TRNs are only permitted to charge VAT on invoices.

Verify the TRN if you have any concerns over other businesses, or if there is any doubt as to whether the TRN is valid. Validating the business comes with lots of questions, like:

how to check company name with trn number?

how to check trn number?

how to verify trn in uae?

how to check trn online?

If you have the below questions, then follow the below guide.

Federal Tax Authority TRN Number Verification

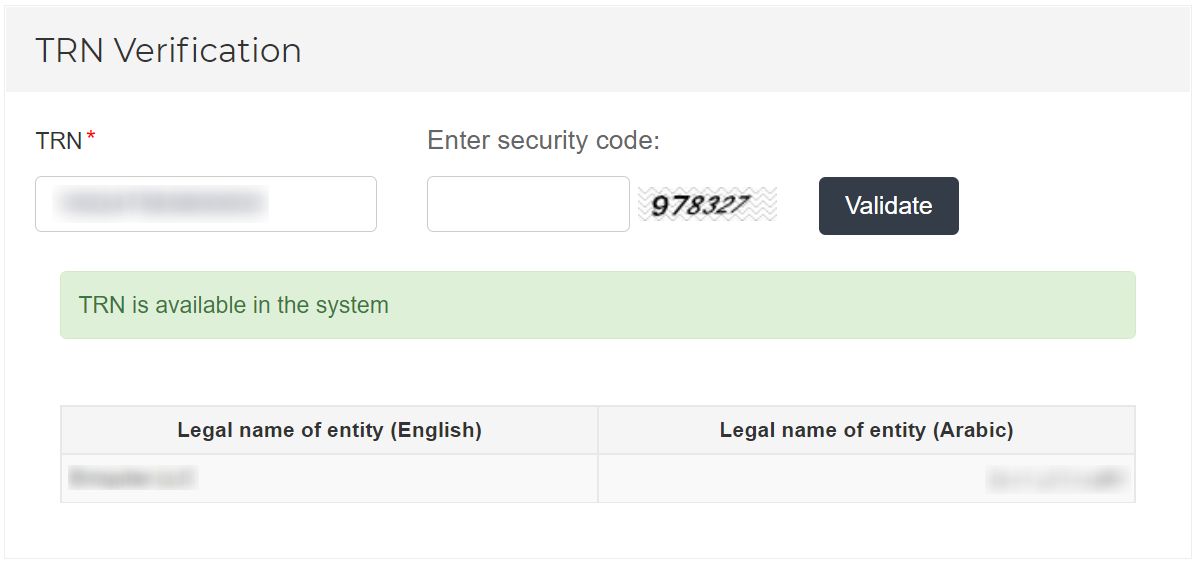

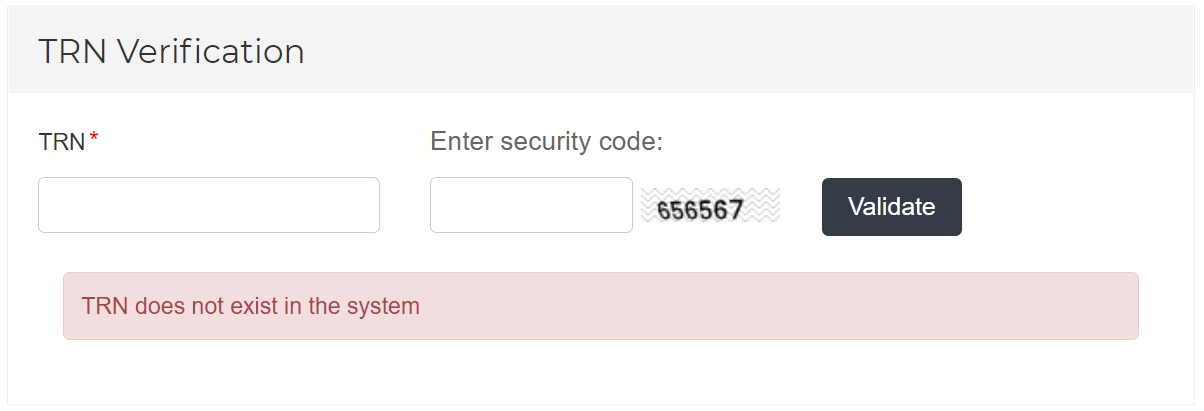

You can verify your TRN at the Federal Tax Authority Website.

➤ Open https://eservices.tax.gov.ae/en-us/trn-verify

➤ On the screen, you have to enter the TRN number of the supplier (The TRN is the 15 digit number of the business)

➤ Along with the TRN, you have to enter the security code displayed onscreen.

➤ Once done, click the ‘Validate’ button.

For entities that have a valid TRN, the portal displays both the English and Arabic versions of the Legal Name

If TRN is Valid and available in the system, you will see its business name shown in English and Arabic.

If TRN is invalid and not available in the system, you will see the error saying “TRN does not exist in the system”

➤ This verification process can be used by anyone in the UAE with or without a VAT registration to ensure that they are only making payments to VAT-registered businesses.

➤ Whenever businesses submit their VAT returns, they should verify the validity of the Tax Registration Number of their suppliers using the given tool.

What is TRN Number In UAE?

A TRN is a unique 15-digit number to differentiate the business.

Usually starts with 100. A typical TRN looks like 100-xxxx-xxxx-xxxx

Businesses and individuals use this code to keep track of taxes.

TRN number ensures that the business is a registered one and allows businesses to claim input tax credits.

The only person who can charge VAT on supplies is one who has a valid TRN.

A business registered with the TRN must always mention the number on all tax-related documents including:

- VAT Return

- Tax Invoice

- Tax Credits

- Additional documents are required for stating the TRN as per UAE VAT laws

Consumers in the UAE are being asked to demand tax to prevent tax fraud.

In the United Arab Emirates, there are a number of businesses with false tax registration numbers. Therefore, if you do not wish to pay unethical VAT, make sure to verify and check the TRN (VAT verification).

Check the TRN number on each bill to ensure that VAT is included.

False TRNs might include:

- TRNs that are less than 15 digits or greater than 15 digits

- Not starting with 100 number

- Incorrect format

What are the steps to report a fake TRN?

In the event that you notice someone using a fake TRN, you can contact the authorities via the VAT helpline or via email:

VAT Helpline Contact Number: 600 599 994

VAT Complain Email Address: info@tax.gov.ae

VAT Registration: Primary Objectives

- Taxes collected from customers must be paid to the government by the eligible organization.

- Likewise, the organization must be reimbursed for taxes it has paid to its suppliers.

- Businesses with supplies and imports exceeding AED 187,500 can opt to register for VAT. Not needed if it’s less than that.

- The taxable supplies and imports of businesses exceeding AED 375,000 must be registered to pay VAT.

- A foreign business can recover VAT in the UAE when visiting.

Learn more bout VAT registration in UAE

Online VAT Calculator

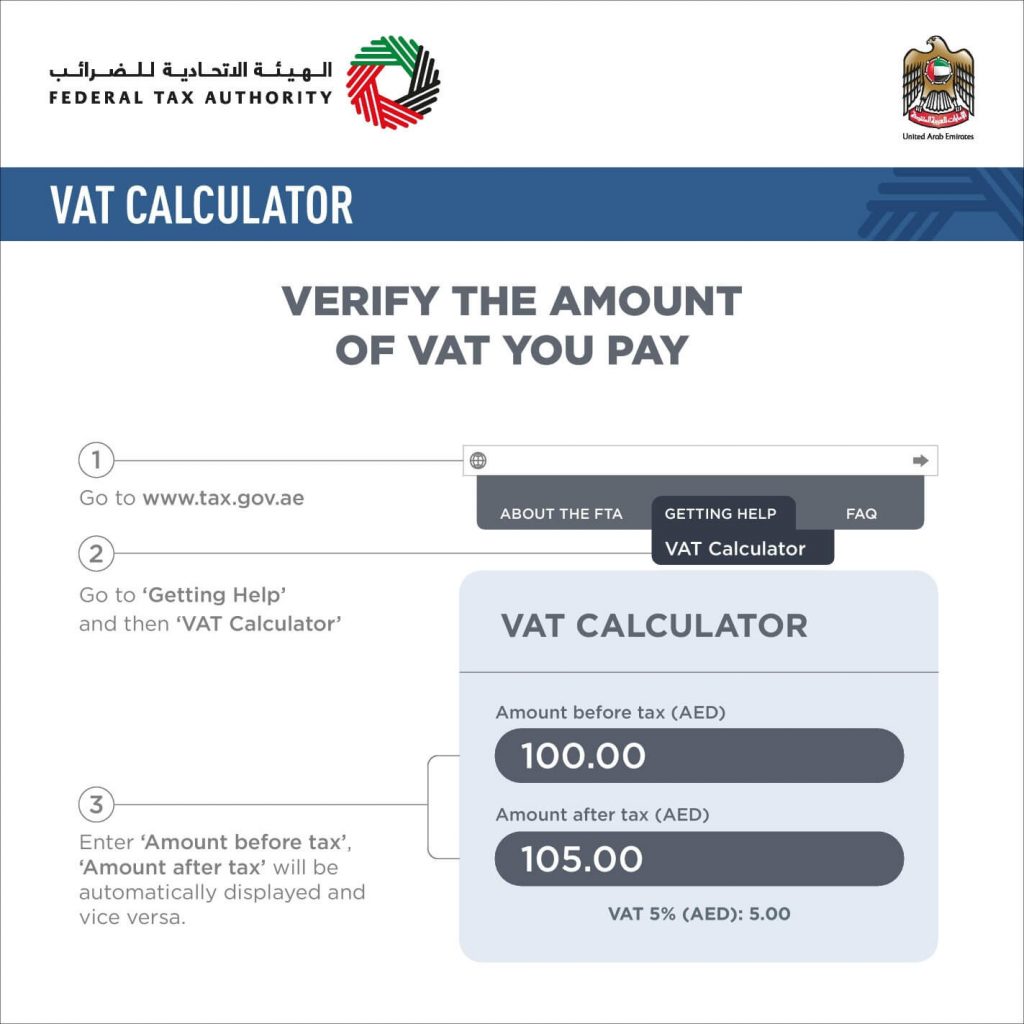

The FTA launches an online VAT calculator to check the authenticity of tax invoices.

Furthermore making it possible for consumers to calculate the amount of Value Added Tax (VAT) due on their purchases.

In turn, this ensures to protect consumers and prevent price manipulation.

To access the calculator,

- Log in to the FTA website

- Under the “Getting Help” tab of the website. Click on the VAT Calculator.

- Enter “Amount before tax”

- The “Amount after tax” will be automatically displayed and vice versa.

A fake Tax Registration Number (TRN) isn’t uncommon. A fake TRN can harm businesses.

As a tactic to make sure your business is conducted ethically and safely in the UAE, you must learn about TRNs to prevent suppliers from cheating you by using fake TRNs.

Validating the Tax Registration Number (TRN) can help a business avoid bad input credit invoice losses.

Therefore, VAT verification is essential for safe value-added tax claims.

Be

Be

Leave a reply